April 2013

| Business World Magazine | 325

the leadership of local community banks

were still getting-up each morning, going to

work, making loans and continuing to serve

despite facing enormous odds. “They kept

their little towns going and helped get us

through the crisis,” says Fine. And while the

truth of that statement resonates with mem-

bers of the ICBA, the very same sentiments

have been shared by principals of the Federal

Reserve, theWhite House and financial ana-

lysts throughout the country.

“What’s more, community banker’s

emerged with their reputations intact. You

don’t see headlines of community banks

cheating customers. They’re towing the line

every day and serving in their communities.

Our executives are the people that buy the

scoreboard for the local football team. They

purchase candy from the kids. They buy

school bonds and participate in programs

vital to their communities. The Wall Street

bankers’ reputation may be in tatters, but

ours is very much intact.”

Fine says as community banks increas-

ingly incorporate technology to offer range

of convenient services and their traditional

“nimble” management approach that allows

for faster response to customer needs, the

small banks will not only be positioned to

compete against the larger banks, but more

effectively capture the hearts of customers

that appreciate the autonomy, reliability and

relationships fostered from engaging in busi-

ness with the local community bank.

For anyone wanting to go local, or simply

go in to offer a word of thanks for their ser-

vice, April’s Community Banking Month of-

fers an opportune occasion. Of course, Fine

might agree that today is a good day too.

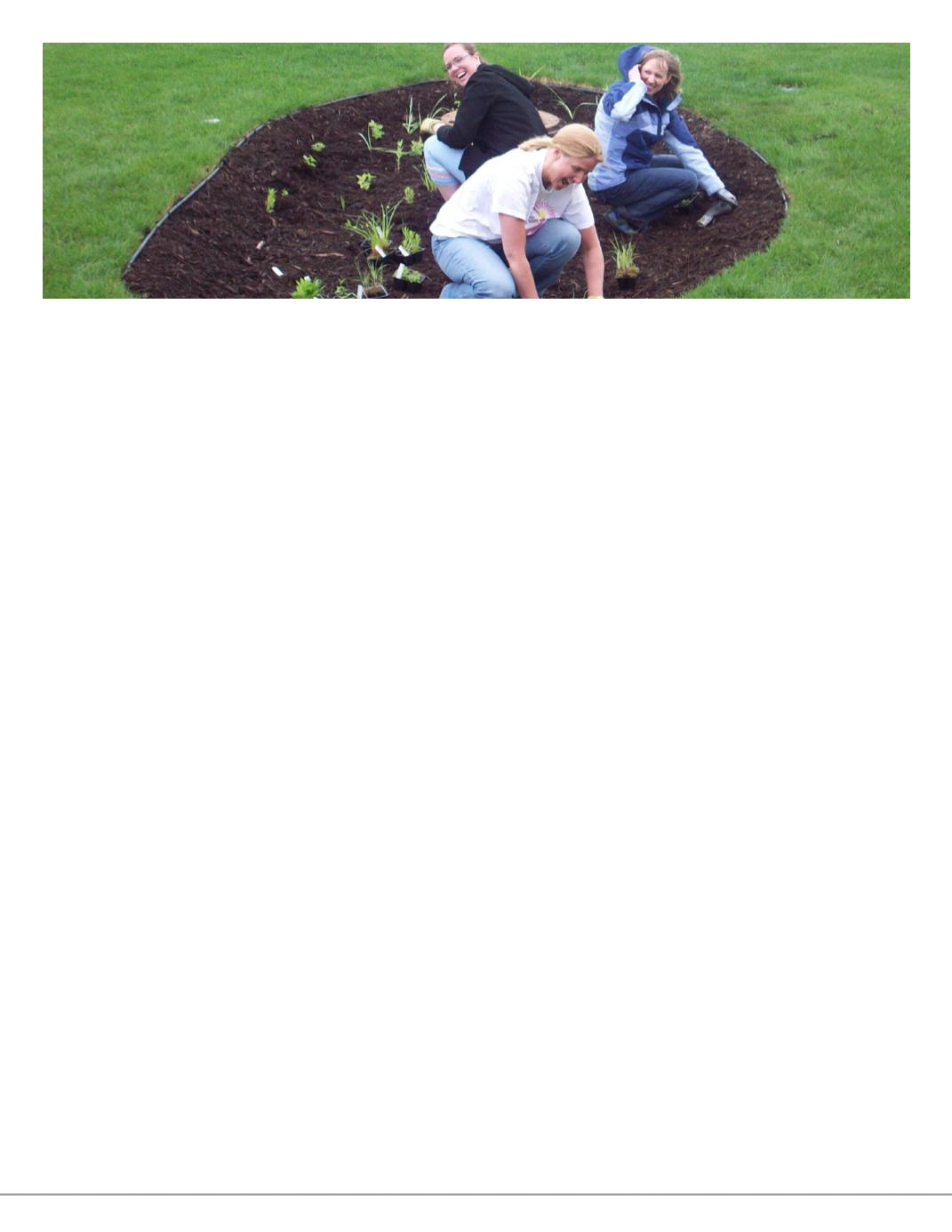

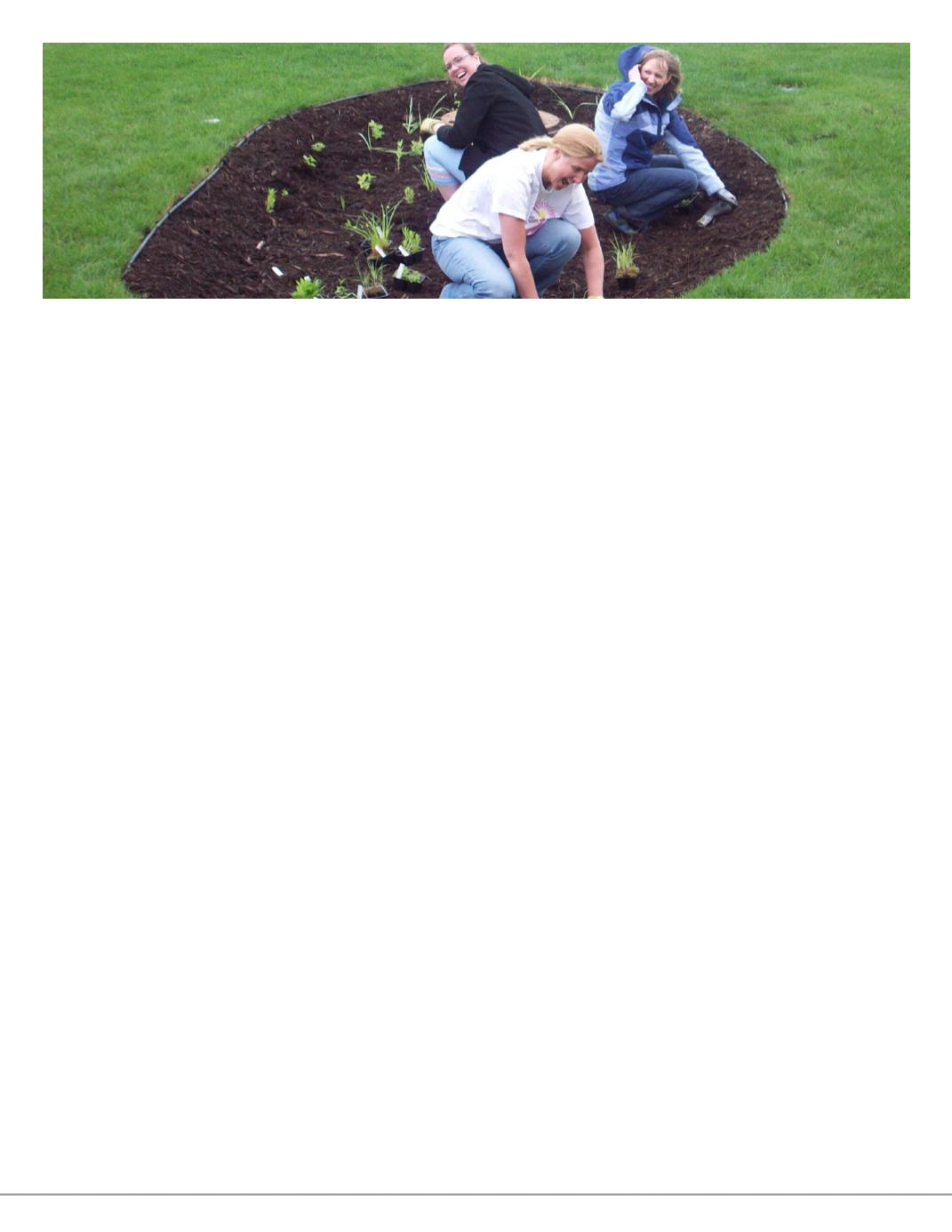

Employees of Reliance Bank in Faribault, Minn., pitched in to build a rain garden in the community bank’s yard. The employees

worked with the local soil and water conservation board and prepared the 80-square-foot garden, which uses native

plants to filter pollutants and prevent runoff.