Putting together a great company

Putting together a great company

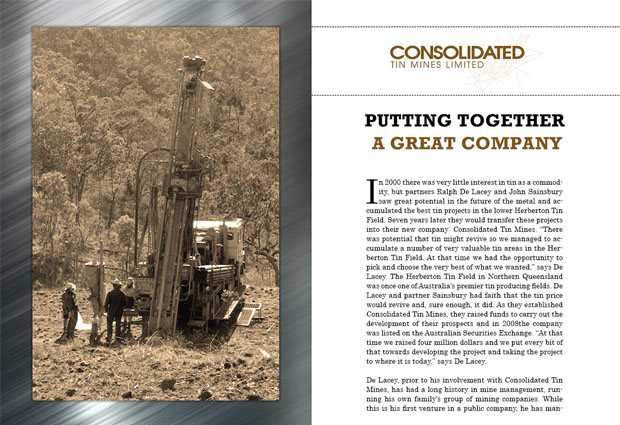

In 2000 there was very little interest in tin as a commodity, but partners Ralph De Lacey and John Sainsbury saw great potential in the future of the metal and accumulated the best tin projects in the lower Herberton Tin Field. Seven years later they would transfer these projects into their new company: Consolidated Tin Mines. “There was potential that tin might revive so we managed to accumulate a number of very valuable tin areas in the Herberton Tin Field. At that time we had the opportunity to pick and choose the very best of what we wanted,” says De Lacey. The Herberton Tin Field in Northern Queensland was once one of Australia’s premier tin producing fields. De Lacey and partner Sainsbury had faith that the tin price would revive and, sure enough, it did. As they established Consolidated Tin Mines, they raised funds to carry out the development of their prospects and in 2008the company was listed on the Australian Securities Exchange. “At that time we raised four million dollars and we put every bit of that towards developing the project and taking the project to where it is today,” says De Lacey.

De Lacey, prior to his involvement with Consolidated Tin Mines, has had a long history in mine management, running his own family’s group of mining companies. While this is his first venture in a public company, he has managed fairly large companies with mining operations and thus far he has done quite well.

The Herberton Tin Field

The Herberton Tin Field was first discovered in 1886 and had a very prosperous life for the next century. In 1990, however, the price of tin collapsed and there was no longer any tin mining occurring. Eventually this changed again. Currently there is a lot of interest in tin globally,as world tin supplies from existing mines is depleting and new uses are increasing demand, which means an increase in tin price. De Lacey and Consolidated Tin Mines have developed an exploration and development model that has focused on areas with historical,mining or exploration success, with the view to explore the easily accessible lower-grade ore that is still available in the area. He says that even after more than a century of mining for tin in this vast area,it is still probable that there will be undiscovered high-grade ore near the surface. By focusing on the known, near surface lower grade ore that is available in larger quantities, they can generate high returns.”Our Model is to develop a central mill with the economy of scale to treat the lower grade ore, and there is plenty of that lower grade ore at surface,” De Lacey says. Consolidated Tin Mines is notlooking for a single minesite to produce the volume of ore they are looking at, instead they are looked at combining multiplemine sites into a single project with ore from several mines supplying a single mill.

The Mount Garnet Project currently consists of the Gillian Project, the Pinnacles Project, and the Windermere Project. The Gillian Project, De Lacey explains, is the most advanced project,with the most work done so far. To date (as of February 2010), Consolidated Tin Mines has drilled a total of 4.454 metres across 81 holes at the project and it has a JORC Resource measure of three million tonneswith 1.2 million tonnes in the JORC Measured category. “We’ve just finished another drilling campaign on Gillian and we will bring more into the Measured Resource category,” says De Lacey. Nonetheless, Gillian, Windermere, and Pinnacles are all part of a whole concept, and all three are important to the overall development plan.

Trends & challenges

As prices rise and fall, Consolidated Tin Mines has to be ready to deal with the challenge these cycles present. “Price is always a challenge,” says De Lacey, “Tin is a good price at the moment and the future of tin looks good with new uses for tin being developed constantly.” In addition to price there is constant competition for land for different purposes, thoughthis is not a big issue in the Herberton tin field, as the area has a long history of mining.

A part of the community

De Lacey identifies one of their major challenges as environmental. “The Herberton Tin Field was mined for over a century,from 1886 to around 1990, then mining ceased because of the price collapse. Mining did not stop because the tin was mined out; it stopped because the tin price collapsed. With the revival of the tin price,people are now getting back into the tin field and looking to establish tin mining operations,” says De Lacey. “It is a mining area so the people who live there definitely understand the mining process,but during the downturn of the tin industry a small proportion of new people moved to the area and some of these people don’t understand mining. Plus there are always extreme single self interest people who will create difficulties.”

Consolidated Tin Mines is extremely aware of their environmental responsibilities. “There is an unbelievable amount of environmental policies and constraints that we work under,” says De Lacey.”Where we work is right in the middle of Lower Herberton Tin Field whichhas a scattering of houses and small farms, so we have to deal with a lot of people and landholders. In addition to being monitored by the government, he explains that they are also monitored by the community in which they work.

Tin focussed

“We’re a small company with an enormous project at Mount Garnet,” says De Lacey. He describes their focus as unique in this sense. Consolidated Tin Mines is currently working on an extremely large project which has enormous potential. During the Global Financial Crisis they had difficulty raising the necessary funds and therefore were put back. “We listed on the ASX for the express purpose of raising funds to develop the project and it’s been almost impossible to do so during the last few years. It has made our challenge extremely difficult. We would have been a lot further advanced than we are now had we been able to raise the funds we needed,” explains De Lacey. Investors have been nervous about investing in new projects, but De Lacey points out that they are not at the beginning stages of the project. “We are a development company, not an exploration company,” says De Lacey. “Consolidated Tin Mines has accumulated areas that were discovered and alreadywell explored by other mining companies and taken to a certain point. Consolidated Tin Mines has taken the projects on to the next level of development, with the express purpose of bringing them into a mining operation. It’s very different to other exploration companies that go out and look for deposits and invest money in drilling holes to see if they can find something,” he explains. “We have the deposits that other companies have spent millions of dollars exploring and we are now developing them. That`s sort of what sets us apart from a lot of other exploration companies.”

The future of Consolidated Tin Mines

As the company grows, they see a bright future. “We will be producing about 5,000 tonnes of tin metal and about 300,000tonnes of magnetite per annum which at its current price is around 180 million dollars in turnover.So, if all goes well we will be a major mining company within the next three years,” says De Lacey. Since the company has already demonstrated the continuing availability of ore in its holdings, they are sitting on a proverbial gold mine of tin.