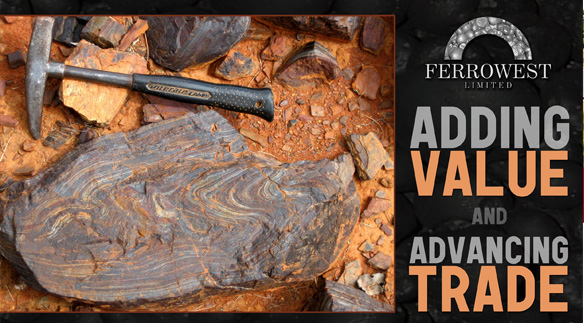

Adding Value and Advancing Trade

.

Ferrowest Managing Director Brett Manning says that one of the driving forces behind the company is its desire to create a value added product out of the iron deposit they have exclusive rights to. Right now Ferrowest is focused on the proposed Yalgoo Iron Project. At the completion of this project Ferrowest hopes to mine magnetite iron ore, downstream process it and export 1,000,000 tonnes a year of merchant pig iron[i].

Digging up a dream

Ferrowest Limited was formed in 2005. Their goal was, and continues to be, to supply and produce high quality merchant pig iron for export. Ferrowest saw an opportunity to grow this market because of a perceived short fall of available scrap metals in the ever expanding market of steel producers that use electric arc furnaces. Utilising a new technology that emerged out of Japan’s Kobe Steel Limited and the US based engineering firm Midrex Technologies Inc. called the ITmk3?, Ferrowest will be able to produce high quality pig iron nuggets from iron ore. “ITmk3 is a new very efficient method of producing merchant pig iron. It is designed to be used in close proximity to the iron ore mine, so when we went looking for iron deposits that were close to infrastructure we were looking directly at applying this technology to this region.”

Accessibility to natural gas lines, existing transportation links, and infrastructure makes this project much more feasible. “Everything we need is in the one spot to put together a full operation.” Manning says that they will be in full operation by 2014.

This convergence of technologies and a rising market value has taken the form of the development of the Yalgoo Iron Project. This project will aim to mine the magnetite iron ore from the Yogi deposit, which is 100 per cent owned by Ferrowest. The ore will be processed onsite at the mine. Ferrowest and Manning estimate that the Yalgoo Iron Project will produce about 1,500,000 tonnes of magnetite concentrate ore per year. The next step in this process is to ship the ore to Eradu by large transport trucks (called road trains). The Eradu site is ideally located because of its proximity to the Port of Geraldton, which lies roughly 60 km away. The transport distance from the mine to Eradu is 185km door to door, says Manning. The capital cost of the project is an estimated $720 million (AUD); raising that capital, and finalising the environmental and feasibility studies will take about 18 months to complete from the publication of this article. From there, says Manning, the mine processing facilities and the ITmk3? pig iron plant will take about 2 years to complete.

The refined materials produced by Ferrowest is easier to handle than other ore products, will not be damaged by exposure, and returns will be far more per-ton than it would be in a less refined state. If estimates are correct Ferrowest will produce a million tonnes of MPI a year, and in so generating over $450,000,000 (AUD) revenue annually. Many of Ferrowest’s stakeholders and shareholders are what Manning calls “Mom and Dad investors” so instead of large nameless holding firms, they have a list of people who believe in adding value to Australian iron ore before export and are truly depending on the growth and success of the company.

Doing it differently and adding value to exports

“We are a little bit different from the rest of the iron ore space in Western Australia; this State is a big supplier of iron ore to the rest of the world. We dig and ship a lot, but we were never that successful of adding value to that iron ore,” says Manning. “The intention is that rather than selling a product that is 60 per cent iron for export, we are looking at exporting a product that is 96 per cent iron.”? What Ferrowest is looking to do make with their pig iron product and how they plan to achieve it is truly a unique approach for Australia. The main consumers of this merchant pig iron product are steel producers that use electric arc furnaces. “About 30 per cent of the world’s steel producers can use this product,” he says. Electric arc furnaces are usually fed scrap steel, and this scrap often contains more than its share of contaminants.? The pig iron that Ferrowest produces will cut down dramatically the amount of these unwanted pollutants. “By getting people a source of clean iron, with carbon as the only additive, it averages down the other containments that are introduced by the scrap iron feed like copper,” he says.

Changing how the market works

The majority of the current merchant pig iron industry is fuelled by exports from Brazil and is shipped around the world. With Australia’s close proximity to China, Korea, Taiwan and Japan, Manning sees a huge opportunity. ?Shipping pig iron to some of the most prolific makers of steel, he believes that Australia and Ferrowest could benefit immensely from the advantage of their geographic location. Cutting down shipping costs would allow them to undercut their competitors and establish themselves as a stable, lead provider of pig iron in the region. “Where we are in Australia is about half the shipping distance from Brazil to Asia,” says Manning.

“The bigger users of electric arc steel making are Japan, Korea, and Malaysia. China produces about 20 per cent of its steel using electric arc furnaces, whereas the US produces more than 50 per cent of its production using this method,” says Manning.? He also says that the world wide average is about 30 per cent. With many of the mini blast furnaces in China being shut down for environmental reasons, Manning thinks that the demand for pig iron will shortly explode. This demand has already turned China from a significant exporter of pig iron to a rapidly growing importer in the last 10 years.

“While the percentage of the total Chinese steel market is still not huge, even a small change in the demand in a huge manufacturing market like China’s will have a huge impact on the price of pig iron worldwide. This makes for a very exciting time for us,” he says.

Most industries in Australia do not have much use for pig iron, so the development of this industry is predominately for export. “The merchant pig iron product is a much higher value product than just the basic iron ore, which might sell for $120 to $140 US a ton, right now merchant pig iron is selling at $560 US a ton.” This is what Manning means by value added.

The increase in the value of the commodity will allow Ferrowest to ship their products further afield and still remain cost effective. “Merchant pig iron gives us a bit more flexibility,” he says. “The extra margin we will get from ‘value-adding’ will make for a much more stable business.” He estimates that MPI will continue to command about 4-5 times the price of any basic iron ore. This idea of adding value to raw product before export, says Manning, has been a “dream of the West Australian State Government since iron ore shipping began here in the 1960’s.”

Geographic advantages

With the world “settling down” from the financial crisis, China has emerged as an economic superpower. Australia, again because of its proximity and trading history, has also been able to survive most of this without too much of a down shift in its markets. “Because we supply so much energy and raw materials to China our association has become quite strong. ?With this comes opportunities for us, we are looking for a joint venture partner with a major corporation from Asia who can supply funding and help bring the product to the market. There have been some very promising conversations going on in that regard at the moment,” he says. “Finding the right partner is the fist key to the puzzle, but there is a lot of interest in the project coming from Asia,” Manning reports.

A plan for success

While other energy and mining companies have met resistance even at this point, Manning says that they have had no trouble from environmental groups, mostly because the technology they plan to employ uses at least 30 per cent less power (gas and coal) than any other best available technologies on the market. “With our surveys, in a place like Western Australia, we have actually added to the knowledgebase, especially in the area of flora and fauna. It’s just so vast an area that its only when a project like this happens do we get to look at the ecological make-up of the area.” They are also examining green technologies such as solar power to integrate into the project right from the start. Investment in green technologies is something that Manning says will in the long term more than pay for itself.

With positive results and increasing interest in Ferrowest, Manning is confident that the project will continue to “stack up quite well”. Pulling together all the components will make this project successful; with the infrastructure and transportation lines already in place, and its own source of iron ore for in excess of 30 years of operations – Ferrowest is in the unique position to know that it is bound to come out a winner.

[i] Pig iron has a very high carbon content which makes it brittle and not useful directly as a material except for limited applications. Pig iron is further refined into steel. Pig Iron gets its name from the shape of the moulds that were used; the “Sow” in this case was a small runner that fed the “Piglets” which were broken off for export and industry use.