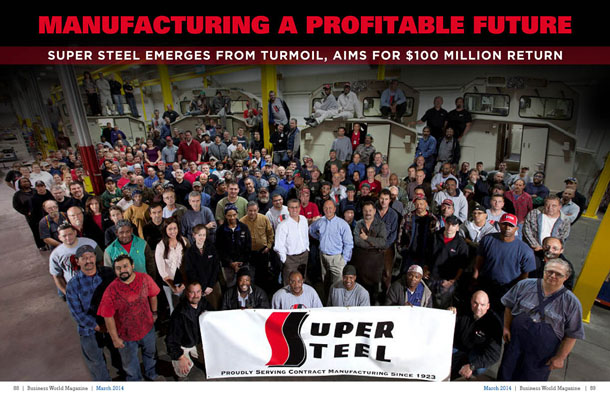

Manufacturing a Profitable Future

Super Steel emerges from turmoil, aims for $100 million return

Dirk Smith has no fear of high expectations.

And considering the depths from which the company he runs – Milwaukee-based Super Steel – has emerged over the last several years, the lofty future goals are a suitable second chapter to what’s already been a quite compelling rags-to-riches business tale.

“In 2010, we did about $27 million (in revenue). This year, we’ll probably do about $68 million,†he says. “We turned the company around. We got it back on stable ground. I would say the turnaround is behind us and we’re back into rebuilding foundation, gaining market share, gaining brand awareness and creating a culture of winners and folks here that want to be part of a greater solution.

“We really have a solid strategy to get the company back to $100 million by 2017.â€

Not all that long ago, such a target would have been more ludicrous than lofty.

The company was created in the 1920s as a small contract manufacturer whose products included metal sills and frames for basement windows. It was purchased in the mid-1960s by a small group that included Fred Luber and, as Smith says, “really took off†from that point – ultimately growing to a near $100 million entity with a staff that swelled to as many as 800 employees

Luber, by then in his 70s, sold the business to the management team in the early 2000s. That transaction, however, triggered a series of failed leveraged buyouts, which brought with them numerous incoming and outgoing presidents and prompted a gradual erosion of a company that became saddled with debt and a lack of confidence as the national economy worsened.

It was put into Chapter 128 receivership – Wisconsin’s version of a formal bankruptcy proceeding – in early 2010, which drew Luber, at age 85, back into the mix when he and a son, Paul, repurchased the business and brought Smith in to oversee daily operations as president and chief executive officer.

Smith had known Paul Luber for several years and was himself a veteran of 25 years in contract manufacturing, including three similar stints in which a full company reboot was needed.

“It wasn’t anything foreign to me – A: contract manufacturing; and B: a turnaround situation,†he says. “Having the highest respect for the Luber family, I embraced the opportunity.â€

Super Steel has reduced both its cost structure and its footprint since the most recent transition, and Smith says the imminent $100 million target will be reached with the company housed in one facility rather than the three in which it previously operated.

Cost structures are now in line with competitors, he says, and market share is incrementally being regained as well. The company’s staffing level dipped as low as 175 earlier in the decade before the transfer of power back to the Lubers, but it’s since grown back to more than 400.

A recent series of job fairs, in fact, will result in the hiring of 30 to 40 more welders in the next few months and Smith’s expectation is that staffing will ultimately reach a peak level that’s “closer to the 650-700 range†as revenue figures increase toward triple-digits.

“We have a 450,000-square-foot facility, so we’ve got plenty of real estate,†he says. “The beauty there is we can go from $65 or $68 million up to $100 million without any brick and mortar. It’s just manpower and leveraging the off-shifts, which is a great model to grow under because it’s all incremental variable.â€

The burgeoning workforce will be capable of multiple services, too.

The company’s new-school value proposition goes far beyond its signature contract manufacturing, metal work, painting and welding capabilities, Smith says. The updated aim is to continue to boost benefits beyond those traditional services, with the addition of assemblies, hydraulics, etc., that turn the facility into a one-stop shop for its highest-end customers.

Among the companies Super Steel works with toward that end are New Holland, Caterpillar and John Deere, three of the agricultural industry’s main players.

“We’re with the big blue-chip guys. We build complete whole goods for New Holland, for example,†he says. “We’ll build bale-wagons complete.  We’ll do the fabrications, purchase the components for it, assemble it complete, decal it, load it on a truck and send it to their distribution center without them ever seeing it.â€

Transportation is another key sector for the company, whose expertise allows it to build out a complete locomotive cab assembly, equip it with as many as 500 purchased-part components and test it in-house before sending it off to railroad customers like GE Transportation or Caterpillar Rail, who can drop the assembly onto a chassis and weld it into place.

“As opposed to them buying 5,000-plus components, they just buy one component from me and I make their job easier,†Smith say. “We’re all about a partnership, a collaborative effort, a design-for-manufacture ability. It’s really our value proposition: How can we help you design in quality while designing out costs? How much can we do for you? How much value-add can we do?â€

Not surprisingly, the optimism from the corner offices has trickled down to the production floor.

The Lubers have invested nearly $8 million in equipment, facilities and grounds – alongside the development of the core competencies – over the last few years since reacquiring the business, which creates a better working environment and translates to transition-weary employees not looking around in anticipation of the next delivery of bad news.

“It gives them a good sense that we’re going to be here for the long haul. They’re seeing the new work, the differentiation, the diversification of customers and our backlog is very strong,†Smith says. It was a process, there’s no question. There was some wait-and-see, and just through executing what we said, we started to get the bandwagon filled back up.

“People started to embrace it and we got critical mass. Since then it’s just become a way of life.â€

———————-

AT A GLANCE

WHO: Super Steel

WHAT: Provider of prototyping, manufacturing, production fabricating, coating and assembly services

WHERE: Milwaukee, Wis.

WEBSITE: www.SuperSteel.com